Ambill for SaaS: Revenue Recognition & Accrual Automation

Streamline billing, invoicing, reconciliation, and collections for B2B SaaS companies. Ambill tackles the critical challenge of accurate revenue recognition amidst diverse billing plans and complex cash-to-revenue timelines.

Powering Growth for Innovative SaaS Companies

Ambill helps B2B SaaS businesses streamline revenue operations, enhance financial visibility, and accelerate growth by automating complex billing and revenue recognition processes.

The Revenue Recognition Challenge for SaaS

SaaS finance teams grapple with accurately recognizing revenue due to varied billing models and the shortcomings of existing tools.

Diverse & Complex Billing Plans

SaaS businesses cater to clients with annual, quarterly, postpaid, prepaid, and hybrid plans, making billing management intricate.

Revenue Recognition Inaccuracies

Difficulty in tagging service periods, tracking unbilled revenue, and managing deferred revenue leads to manual, error-prone processes.

Lack of Automated Accrual/Deferral

Popular tools like Zoho Books often lack support for automated accrual, deferral, or unbilled revenue tracking, requiring manual workarounds.

Fragmented Reporting

Manual efforts and disparate systems result in fragmented MIS reporting and a lack of clear visibility into true revenue performance.

Ambill's Solution: Modular Workflow for SaaS

Ambill modularizes the billing process and integrates revenue recognition logic directly into your subscription workflows, solving the core SaaS revenue recognition gap.

Customer Creation

Onboard new SaaS customers seamlessly.

Contract/Subscription Config

Define plan, pricing, term, and usage thresholds.

Billing Details Input

Manage one-time charges, recurring items, and usage pricing.

Payment Link & Capture

Generate and capture payments efficiently.

Automated Invoice Creation

Invoices generated based on plan and usage data.

Customer Portal Access

Provide clients with access to their billing information.

Revenue Accrual & Reporting

Automated revenue recognition and detailed financial reports. This is Ambill's key differentiator for SaaS.

Automated Revenue Recognition

Ambill automates the revenue recognition process, ensuring accurate and timely recognition of revenue.

Core Functionality

Inside Ambill's Revenue Recognition Engine

Ambill's engine independently tracks key revenue components and supports granular metadata for precise financial control.

Independent Revenue Tracking

- Accrued Revenue Tracking

- Monitors earned monthly revenue based on contract delivery, independent of invoicing cycles.

- Deferred Revenue Management

- Handles payments received in advance but not yet recognized as revenue, ensuring compliance.

- Unbilled Revenue Identification

- Tracks revenue accrued for services delivered where invoicing is delayed or pending.

Structured Contract & Invoice Metadata

- Start Date / End Date

- Clearly define service periods for accurate revenue spreading.

- Recognition Schedule

- Flexible schedules to match various contract and revenue models.

- Usage Logs Integration

- Connect usage data for metered billing and precise postpaid revenue accrual.

- Expected Invoice Date

- Forecast invoicing and align it with revenue recognition timelines.

Practical Applications

Ambill in Action: Real-World SaaS Scenarios

See how Ambill handles common yet complex revenue recognition situations faced by SaaS businesses, providing clarity and accuracy.

Deferred Revenue (Advance Payment)

A client pays ₹1,20,000 for a 12-month contract.

Ambill automatically recognizes ₹10,000/month and defers the remaining ₹1,10,000, ensuring accurate monthly revenue reporting.

Unbilled Revenue (Late Invoice)

A project starts in April, but the invoice is only raised in July.

Ambill logs April's earned revenue as 'Unbilled' and seamlessly syncs it to recognized revenue once the invoice is generated.

Usage-Based Accrual

Metered usage data is logged for a postpaid client.

Usage is multiplied by the contracted rate to generate precise monthly accruals, even if the invoice is pending or consolidated later.

Streamlined Financial Operations

Comprehensive Reporting & Seamless Integrations

Ambill provides robust financial and MIS reporting capabilities, offering clear insights into your SaaS revenue streams. Plus, easily integrate with your existing accounting stack.

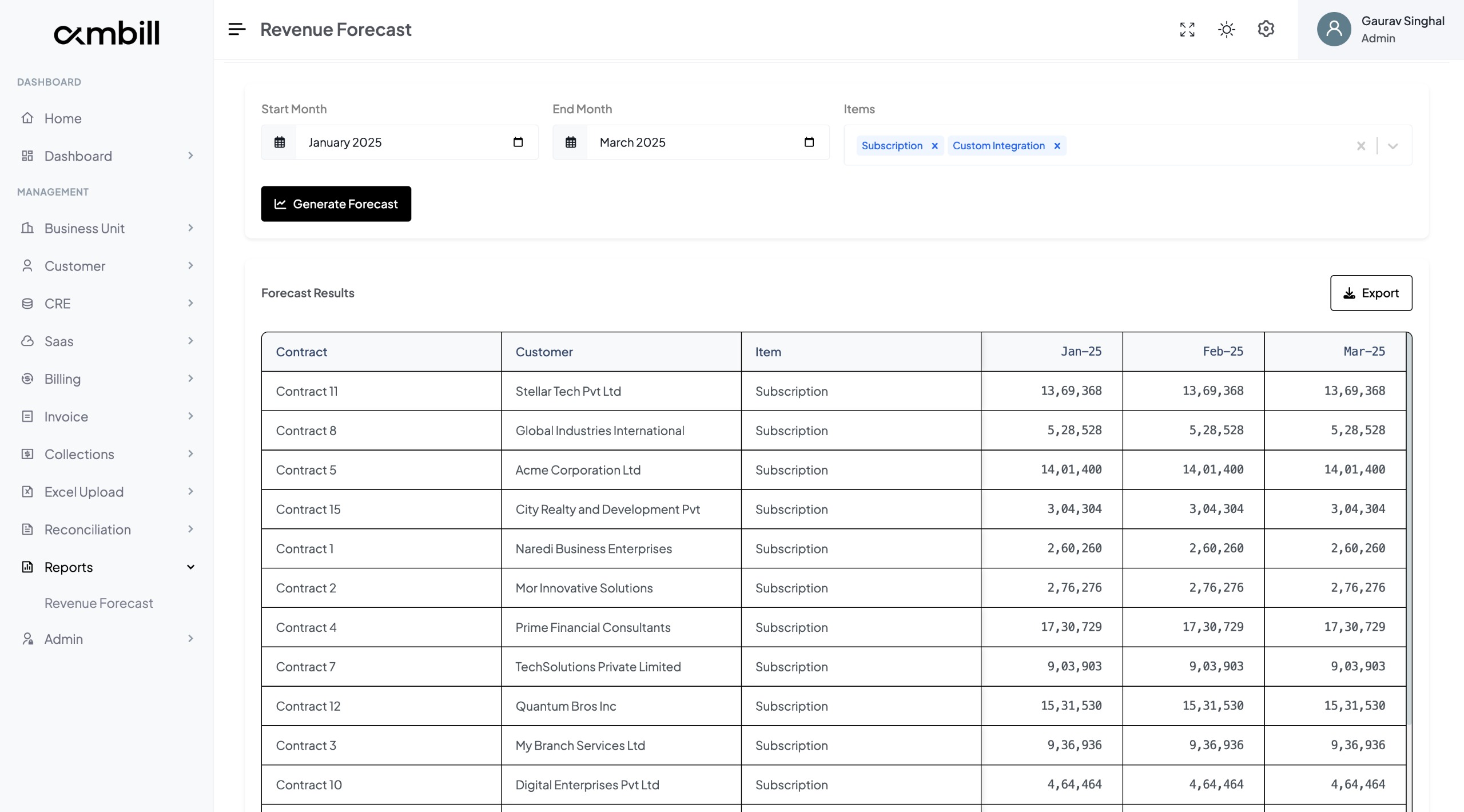

- Revenue Accrual Reports

- Deferred Revenue Ledgers

- Unbilled Revenue Dashboards

- Invoice vs Revenue Recognition Timeline Views

- Excel/CSV Export for Zoho Books or custom integration

Integration with Zoho Books & More

While tools like Zoho Books may lack native support for complex SaaS revenue recognition, Ambill bridges this gap by:

- Exporting monthly journal entries compatible with Zoho Books.

- Pushing structured reports or summary ledgers for easy import.

- Offering custom API-based synchronization for other accounting tools and ERPs.

Ambill ensures your recognized revenue data flows smoothly into your primary accounting system, maintaining a single source of truth.

Empowering SaaS Finance

Key Benefits for Your Finance Team

Ambill transforms SaaS revenue operations by automating complex processes, ensuring accuracy, compliance, and providing clear financial insights.

- Fully Automated Revenue Recognition

- Eliminate manual calculations and ensure timely, accurate revenue reporting aligned with contract terms.

- Eliminates Error-Prone Spreadsheets

- Move beyond complex, fragile spreadsheets, reducing the risk of errors and improving data integrity.

- Provides Clean, Auditable Revenue Schedules

- Generate transparent and easy-to-audit revenue data, simplifying financial reviews and closures.