Streamline TDS Reconciliation with Form 26AS Automation

Ambill's intelligent reconciliation engine automatically matches Form 26AS data with your books, identifies discrepancies, and helps recover TDS receivables faster with actionable insights.

Discover how our TDS reconciliation can transform your quarterly tax compliance process in just 15 minutes.

The TDS Reconciliation Challenge

Why Form 26AS Reconciliation Is Critical Yet Challenging

Every quarter, businesses face the complex task of reconciling TDS (Tax Deducted at Source) amounts. This process involves matching what customers have deducted from your invoices with what they've actually reported to the tax authorities.

The Hidden Challenges of TDS Reconciliation

Manual Form 26AS reconciliation creates inefficiencies, delays recovery of TDS receivables, and increases compliance risks.

Complex Form 26AS Data Format

Raw Form 26AS text files are difficult to parse and interpret, requiring manual conversion to usable formats before reconciliation can begin.

Discrepancy Identification Challenges

Manually comparing TDS entries between Form 26AS and accounting records is time-consuming and error-prone, leading to missed recovery opportunities.

Delayed TDS Receivable Recovery

Without efficient reconciliation, businesses face delays in identifying and recovering TDS amounts that customers have deducted but not properly reported.

Quarterly Compliance Burden

The quarterly reconciliation process creates significant workload for finance teams, taking focus away from strategic activities.

The Ambill Workflow

Transforming TDS Reconciliation

From a multi-day manual chore to an automated process that takes minutes. Here's how we do it.

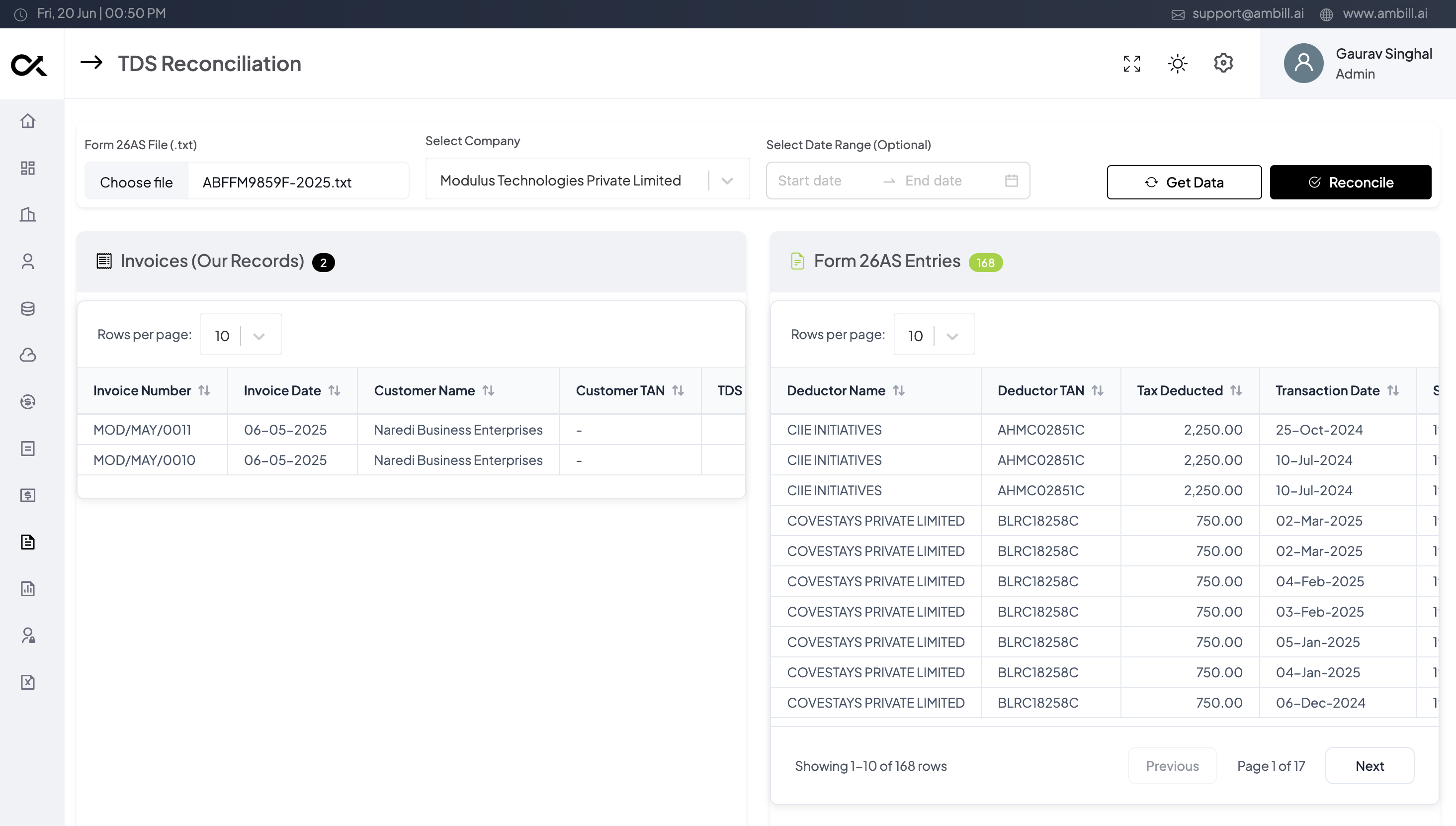

Upload Form 26AS

Simply upload the raw .txt file of Form 26AS downloaded from the income tax portal.

Intelligent Parsing

Our system automatically converts the complex Form 26AS format into structured, analyzable data.

AI-Powered Matching

Advanced algorithms match TDS entries with your accounting records with high accuracy.

Discrepancy Identification

System highlights mismatches between TDS in your books and what's reported in Form 26AS.

Action & Recovery

Generate reports to follow up with customers on discrepancies and recover TDS receivables.

The Tangible Results

Ambill doesn't just save time. It directly impacts your bottom line by ensuring accuracy and maximizing TDS recovery.

95%

Reduction in Man-Hours

99.8%

Matching Accuracy

15%+

Increase in TDS Recovery

Intelligent Reconciliation

Key Capabilities of Ambill Form 26AS Reconciliation

Our platform leverages advanced technology to streamline every step of your TDS reconciliation process.

Core TDS Reconciliation Features

- Intelligent Form 26AS Parsing

- Automatically convert raw Form 26AS text files into structured, analyzable data with our advanced parsing algorithm.

- AI-Powered TDS Matching

- Match TDS entries from Form 26AS with your accounting records using our proprietary matching algorithm with high accuracy.

- Discrepancy Identification

- Instantly highlight mismatches between TDS deducted in your books versus what's reported in Form 26AS.

Reporting & Compliance

- Reconciliation Dashboard

- Comprehensive visual dashboard showing matched entries, discrepancies, and action items for efficient TDS management.

- Customer-wise Reconciliation

- View and analyze TDS discrepancies by customer to streamline follow-up actions and recovery efforts.

- Compliance Documentation

- Generate detailed reconciliation reports for audit purposes and maintain a complete trail of TDS receivables.

Manual vs Automated

The Stark Difference

See how Ambill transforms Form 26AS reconciliation from a time-consuming burden to a streamlined process.

| Aspect | Manual Process | Ambill's Automation | Improvement |

|---|---|---|---|

Processing Time | 40-60 hours per quarter | 1-2 hours per quarter | 97% reduction |

Data Extraction | Manual copy-paste from text files to Excel | Automated parsing with 99.9% accuracy | Zero manual effort |

Matching Accuracy | 85% accuracy with human error | 99.8% accuracy with AI algorithms | 14.8% increase |

Discrepancy Detection | Limited to obvious mismatches | Comprehensive detection of all variances | Complete coverage |

Resource Requirement | 2-3 dedicated finance staff | Minimal oversight required | 80% staff reduction |

Manual Process:

Ambill's Automation:

Improvement:

97% reduction

Manual Process:

Ambill's Automation:

Improvement:

Zero manual effort

Manual Process:

Ambill's Automation:

Improvement:

14.8% increase

Manual Process:

Ambill's Automation:

Improvement:

Complete coverage

Manual Process:

Ambill's Automation:

Improvement:

80% staff reduction

The Bottom Line

Automating your Form 26AS reconciliation with Ambill doesn't just save time—it fundamentally transforms how your finance team operates, freeing them to focus on strategic initiatives while improving accuracy and cash flow.

Real-World Impact

How Ambill Solves TDS Reconciliation Challenges

Discover how businesses across industries leverage Ambill to automate Form 26AS reconciliation and recover TDS receivables faster.

IT Services Provider

A mid-sized IT company with 200+ clients struggled with quarterly TDS reconciliation taking over 3 weeks.

Ambill's Form 26AS automation reduced reconciliation time to just 2 days and helped recover ₹12 lakhs in previously untracked TDS deductions.

Manufacturing Enterprise

A manufacturing firm faced challenges tracking TDS deductions across multiple customer segments and divisions.

Our solution provided customer-wise TDS tracking, enabling them to identify ₹8.5 lakhs in misreported TDS and take corrective action.

Professional Services Firm

An accounting firm needed to reconcile TDS for both themselves and their clients efficiently each quarter.

Ambill's batch processing capabilities allowed them to handle multiple Form 26AS reconciliations simultaneously, reducing processing time by 85%.

Unlock Efficiency & Savings

Key Benefits of Form 26AS Automation

Transitioning to automated TDS reconciliation with Ambill delivers tangible benefits across your finance operations and improves your cash flow management.

- Accelerate TDS Receivable Recovery

- Quickly identify and recover TDS amounts that have been deducted but not properly reported by customers.

- Reduce Reconciliation Time

- Cut quarterly reconciliation time from weeks to hours with automated parsing and matching technology.

- Improve Cash Flow Management

- Gain better visibility into your TDS receivables position for more accurate cash flow forecasting.

- Enhance Compliance Accuracy

- Ensure all TDS entries are properly accounted for and reconciled, reducing audit risks and compliance issues.

Ready to Streamline Your TDS Reconciliation?

Stop struggling with manual Form 26AS reconciliation. Discover how Ambill's AI-powered automation can transform your TDS management and help recover receivables faster.